Beneficial Ownership Information (BOI)

Helpful resources about enforcement, reversals and filings:

- FinCEN issues interim final rule removing U.S. entities from BOI requirements

- Treasury announcement of BOI enforcement suspension

- BOI reporting information from AICPA

- Injunction lifted; FinCEN extends most BOI deadlines to Jan. 13, The Tax Adviser

- Extension to BOI reporting deadline removed from budget bill, Journal of Accountancy

- Court halts BOI reporting; AICPA urges preparedness, Journal of Accountancy

- Corporate Transparency Act Blocked Nationwide by Texas Court, Bloomberg News

- Court Blocks Corporate Transparency Act: A Win For Federalism?, Forbes

- AICPA Statement on BOI Injunction

Background

On Dec. 3. a federal district court issued a decision (Texas Top Cop Shop, Inc. v. Garland) that found the CTA is likely unconstitutional. The decision included an injunction prohibiting the enforcement of the CTA and the BOI reporting rule. The DOJ appealed this decision and the Fifth Circuit Court lifted the injunction on Dec. 23. FinCEN slightly extended BOI reporting deadlines at that time.

Late on Dec. 26, the Fifth Circuit Court, through a merits panel evaluating the parties' claims, vacated the motion to stay the injunction. This decision meant that FinCEN could not enforce BOI reporting requirements . On Dec. 31, the DOJ filed an emergency application with the Supreme Court.

On Jan. 23, the Supreme Court issued a stay of the Dec. 3 nationwide injunction in the Texas Top Cop Shop case prohibiting enforcement of the BOI reporting requirements. However, a nationwide injunction imposed in the Samantha Smith case remained in force.

Legislative activity

On Feb. 10, the House of Representatives passed a bill that would delay FinCEN BOI reporting until Jan. 1, 2026, but it has yet been addressed in the Senate.

The House of Representatives passed H.R. 736, the Protect Small Businesses from Excessive Paperwork Act of 2025 (Rep. Zach Nunn, IA-3) under suspension of the rules by a vote of 408-0. The bill now moves to the Senate for consideration.

Beneficial Ownership Information Resources

The Corporate Transparency Act (CTA), enacted in 2021 and administered by FinCEN, requires reporting of beneficial owners’ information (BOI) from companies, including small businesses. The intent of the legislation is to combat money laundering, tax evasion and other financial crimes. Steep civil and criminal penalties await willful noncompliance. Reporting forms became available on Jan. 1, 2024 with deadlines determined by the date a company was established.

Helpful resources

- FinCEN BOI Frequently Asked Questions

- Risk Management and the Corporate Transparency Act (including sample engagement letter)

- FinCEN BOI Compliance Guide

- Beneficial Ownership Information Reporting Rule Fact Sheet

- BOI Reporting - FinCEN website

- BOI Filing website

- AICPA BOI reporting resources

- ISCPA joins in BOI legislation delay request

What is the CPA's role?

Questions surrounding the CPA's role in assisting clients with BOI reporting remain. As clients ask their trusted advisors for guidance, please know there is still much debate on who should accept the responsibility for the new CTA reporting.

Debate persists on whether non-attorney practitioners advising clients on the new BOI reporting form could be considered an unauthorized practice of law (UPL). While this question has been answered in Iowa, other states have not yet ruled on the matter.

This leaves CPAs in a difficult position, and AICPA and CIMA recommend contacting state regulators, insurance carriers, and legal counsel to further address this issue. They also advise considering whether to address this matter in client engagement letters to clearly state if you will perform CTA reporting services.

The UPL question for CPAs in Iowa

The Iowa Supreme Court, by an order filed Sept. 9, amended the Court’s rule on the unauthorized practice of law to expressly provide that it is not an unauthorized practice of law for non-lawyers to assist clients in preparing, completing, filing, or determining whether to file, Beneficial Ownership Information Reports with Financial Crimes Enforcement Network, a bureau of the U.S. Department of the Treasury (“FinCEN”) pursuant to the Corporate Transparency Act. The order and amendments are included in resources below.

Some additional resources relating to UPL and CPAs on BOI reporting.

- Iowa Supreme Court order adopting amendment (UPL related)

- Iowa Supreme Court - amendments to accompany the order (UPL related)

- CNA Coverage Statement on CTA

- Oh BOI: The Corporate Transparency Act and CPA firms, Journal of Accountancy

- AON Risk Alert on Beneficial Ownership Reporting

- Podcast from AICPA & CIMA titled Traversing the beneficial ownership information reporting requirements.

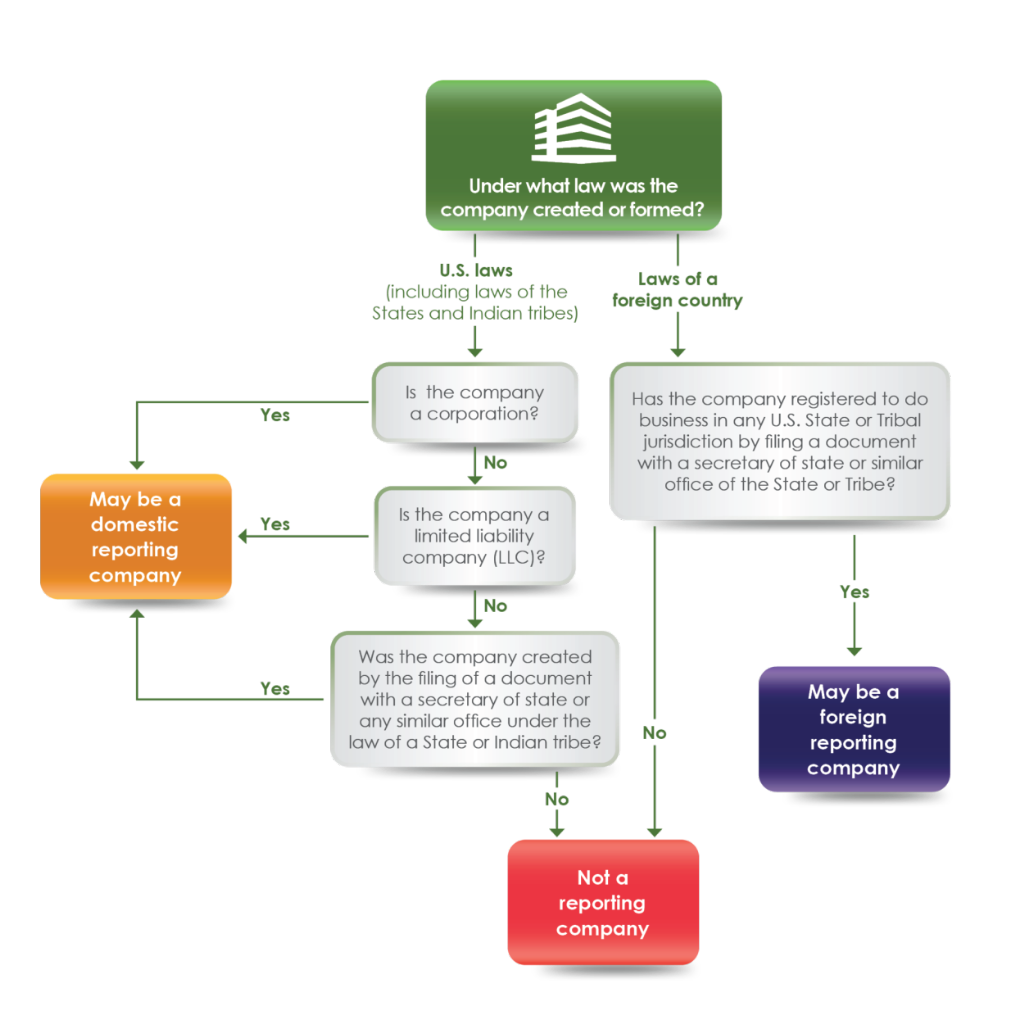

What is a “reporting company”?

The Reporting Rule requires that all “reporting companies” file BOI reports with FinCEN within specified timeframes. A reporting company is any entity that meets the “reporting company” definition and does not qualify for an exemption. There are two categories of reporting companies: a “domestic reporting company” and a “foreign reporting company”. If your company is neither a “domestic reporting company” nor “foreign reporting company” because it does not meet either definition (as described below) or it qualifies for an exemption, then it is not required to file a BOI report with FinCEN. The following chart shows how to analyze whether your company is a “reporting company”.

When should my company file the BOI report?

If your company already exists as of January 1, 2024, it must file its initial BOI report by January 1, 2025. If your company is created or registered to do business in the United States on or after January 1, 2024, and before January 1, 2025, it will have 90 calendar days after receiving actual or public notice that the company’s creation or registration is effective to file its initial BOI report. Specifically, this 90-calendar day deadline runs from the time the company receives actual notice that its creation or registration is effective, or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier. If your company is created or registered on or after January 1, 2025, it will have 30 calendar days from actual or public notice that its creation or registration is effective to file its initial BOI report. For example, your company may receive actual notice that its creation or registration is effective through a direct communication from the secretary of state or similar office. Your company could also receive public notice that its creation or registration is effective because it appears on a publicly accessible registry maintained by the secretary of state or similar office. Notice practices will vary by jurisdiction. If a jurisdiction provides both actual and public notice, the timeline for when an initial BOI report is due starts on the earlier of the two dates notice is received.